8

Linear derivatives

INTRODUCTION

Firms can use interest rate swaps and FRAs to mitigate interest rate risk. These derivatives exchange a variable for a fixed interest cash flow stream or vice versa.

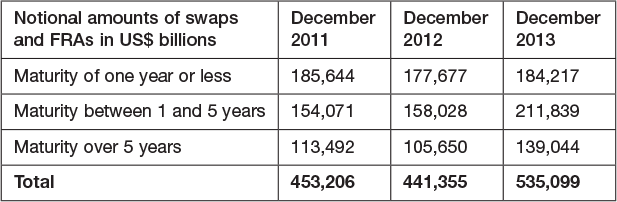

The worldwide OTC market for swaps and FRAs is massive. Table 8.1 shows the notional amounts outstanding in billions of US dollars!1 Be aware that all counterparties are incorporated in the figures, including financial institutions.

Table 8.1 - Notional amounts outstanding

We’ll discuss two types of linear interest rate derivatives: interest rate swaps and FRAs. Interest rate swaps can be split into payer’s ...

Get Mastering Interest Rate Risk Strategy now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.