Separating investment targets

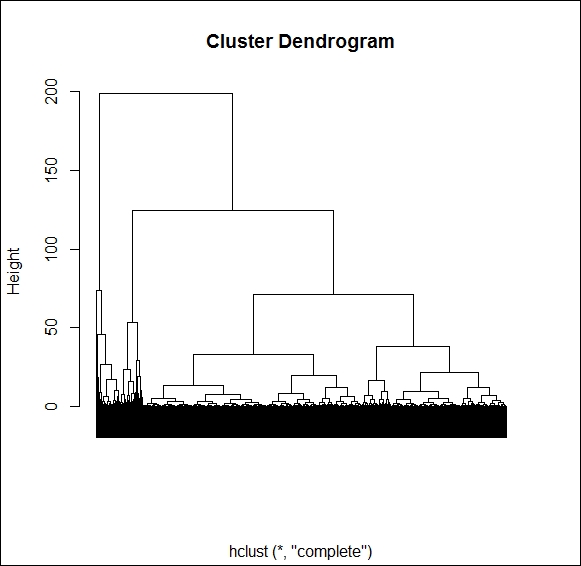

An alternative method to build an investment strategy could be to separate good investment targets and check what is common between them. A good way to find similarities among stocks that performed well could be to create groups based on the TRS values and compare low- and high-performer clusters. The first step to this should be to analyze the following code:

library(stats) library(matrixStats) h_clust <- hclust(dist(d[,19])) plot(h_clust, labels = F, xlab = "")

The following dendogram is the output for the preceding code:

Based on the dendrogram, three clusters separate very well, but to cut the biggest of them into ...

Get Mastering R for Quantitative Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.