FORWARD CURVES: CONTANGO AND BACKWARDATION

The relationship between the spot and forward rate is known as a forward curve and is a function of multiple inputs – including funding, cost of storage, seasonality, supply and demand and current existing inventories.

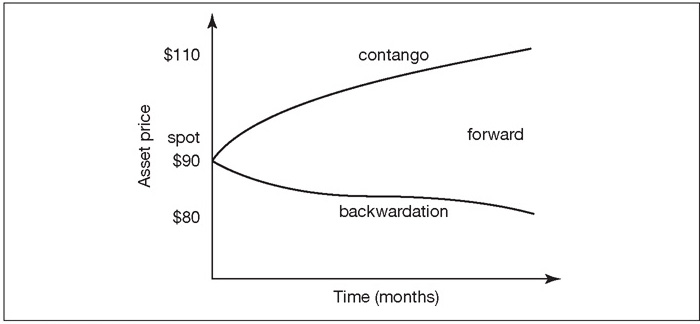

The shape of the forward curve may drive physical stocks and inventories. For example, contango markets tend to incentivise stock building whereas backwardated markets encourage stocks to be drawn down (see Figures 1.5 and 1.6).

Figure 1.5 Contango and backwardation

Source: The Matrix Partnership

A commodity forward curve in contango is equivalent to a normal yield curve in the interest ...

Get Mastering the Commodities Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.