1

Prior to the yield curve: spot and forward rates

1.1 INTEREST RATES, PRESENT AND FUTURE VALUES, INTEREST COMPOUNDING

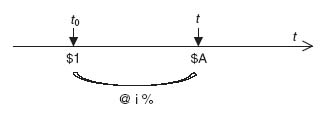

Consider a period of time, from t0 to t, in Figure 1.1.

Figure 1.1 Interest on a period of time, from t0 to t

$1 invested (or borrowed) @ i from t0 up to t gives $A. t is the maturity or tenor of the operation. $1 is called the present value (PV), and $A the corresponding future value (FV). i represents the interest rate or yield.

In this basic operation, no interest payment is made between t0 and t: in such a case, i is called a “0-coupon rate” or “zero” in short. Zeroes are also called “spot rates” as they refer to currently prevailing rates (at t0). Let us denote zt the current zero for a maturity t.

In the financial markets, the unit period of time is the year, and the interest rates, or yields, are expressed in percent per annum (% p.a.), that is, per year. In the US market, interest rates may also be expressed on a semi-annual basis (s.a.) with respect to the market of US bonds paying semi-annual coupons. Database providers, such as Bloomberg or Reuters, do well in always specifying whether the rates they mention are expressed on an annual or a semi-annual basis.

If the maturity t = 1 year, and z1 the corresponding zero rate expressed in % p.a., the relationship between PV and FV is

meaning that the future value FV is the sum of the present value ...

Get Mathematics of the Financial Markets: Financial Instruments and Derivatives Modelling, Valuation and Risk Issues now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.