5

Forward instruments

A forward instrument is the subject of a contract, concluded today, for a transaction scheduled at a future date, but at a price fixed at the time of the contract conclusion. The object of the contract is a buy or sell transaction relative to a financial instrument called the underlying.

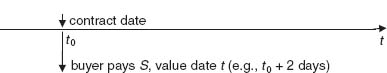

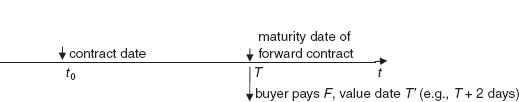

The difference between spot and forward operations on the same underlying, priced S at current time t0, is straightforward, as shown in Figures 5.1 and 5.2.

Figure 5.1 Buy spot @ S

Figure 5.2 Buy forward @ F

Forward instruments are addressed in three chapters:

- Chapters 5 and 6 are dedicated to forward instruments traded on the OTC (interbank) market.

- Chapter 7 looks at exchange markets for forward instruments, called futures, to distinguish them from OTC forward equivalent products.

As such, forward instruments represent the simplest form of “derivative” instruments. Under their most general form, derivatives are involving a forward transaction, which can present different features (cf. further chapters, dedicated to swaps and options).

5.1 THE FORWARD FOREIGN EXCHANGE

The forward foreign exchange market has been developed to answer the following kind of problem. Consider the treasurer of a US corporation, or an investor, knowing he will receive EUR in 6 months. Today, ...

Get Mathematics of the Financial Markets: Financial Instruments and Derivatives Modelling, Valuation and Risk Issues now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.