Chapter 4Incorporating Risk into the Arbitrage Decision

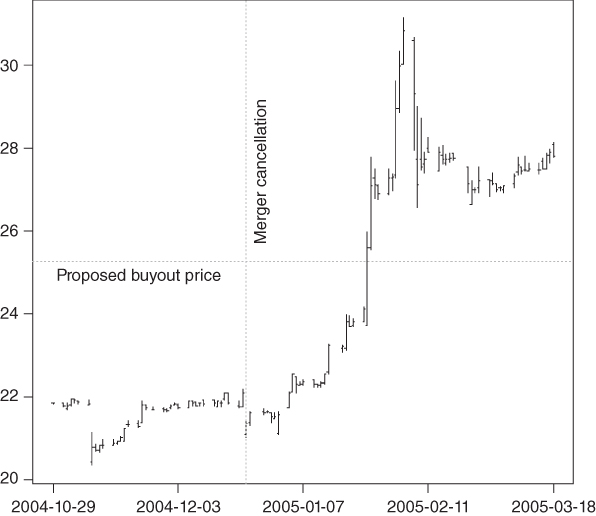

So far, all arbitrages were analyzed under the assumption that the merger would close. Unfortunately, life is not that easy for an arbitrageur. A small number of mergers are not completed. The usual outcome of non-completion is a drop in the share price of the target firm and steep losses for arbitrageurs. However, in rare instances, the collapse of a merger can lead to an increase in a stock's price. This happens very rarely. One of the few cases that I have seen was the attempted acquisition of Unisource Energy by Kohlberg Kravis Roberts & Co. Even in this case, the increase did not happen instantly after the announcement that the Arizona Corporation Commission voted to reject the buyout. On the day of the announcement, Unisource fell (see Figure 4.1). However, over the next month, Unisource rose and eventually exceeded the price that shareholders would have received in the merger. This is the one exception that proves the rule that collapsing mergers lead to a loss.

Figure 4.1 Stock Price of Unisource after the Collapse of the Merger

In other instances, shareholders are relieved when an acquisition fails and the share price appreciates instantaneously.

Most acquisitions are made at a significant premium to the most recent market price. Partly this is justified by the need to motivate current holders to forgo future ...

Get Merger Arbitrage, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.