CHAPTER 6Application of Islamic Products in Treasury

The treasury function, also known as the markets division, of a bank is responsible for funding the other divisions, managing the bank's mismatch and liquidity risks, and making markets to customers in foreign exchange and sukuk. In addition, this division of the bank assists clients in managing their money market and foreign exchange exposures using a variety of Sharia'a compliant contracts.

6.1 Interbank Liquidity

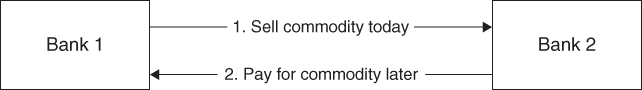

The commodity murabaha is the instrument most commonly used by Islamic financial institutions to provide short-term interbank liquidity. A commodity murabaha is, like the basic murabaha transaction, a deferred payment sale or instalment credit sale and uses a commodity, usually a base metal, as the underlying asset for the transaction. In its most basic form, this transaction involves two banks, one as the buyer of a commodity and one as the seller as can be seen in Figure 6.1.

Figure 6.1 Simple commodity mudaraba structure

As in the murabaha transaction detailed in Section 3.3, the price of the commodity, the mark-up, the delivery date and repayment date are agreed upfront. The intention of this transaction is to replicate conventional money market transactions (i.e. the interbank market), and the banks do not typically hold the underlying commodity nor have a requirement for it. The metals are purchased ...

Get Modern Islamic Banking now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.