Chapter 8Pillar 2 – The Credit Theory of Money

“When the people find that they can vote themselves money, that will herald the end of the Republic.”

– Benjamin Franklin

Let's return to the efficient frontier, the Modern Portfolio Theory introduced by Harry Markowitz. Conceptually, any individual asset has risk and any individual asset has return. In Modern Portfolio Theory, rather than plotting the risk and return of each asset individually, assets can be combined to create a frontier yielding the highest return for a unit of risk with combinations that are called efficient. This makes sense. Investing involves risk; some risks are high, and some are low. Investing involves returns; some returns are positive, and some are negative. The goal, of course, is to have the highest return possible with the least amount of risk.

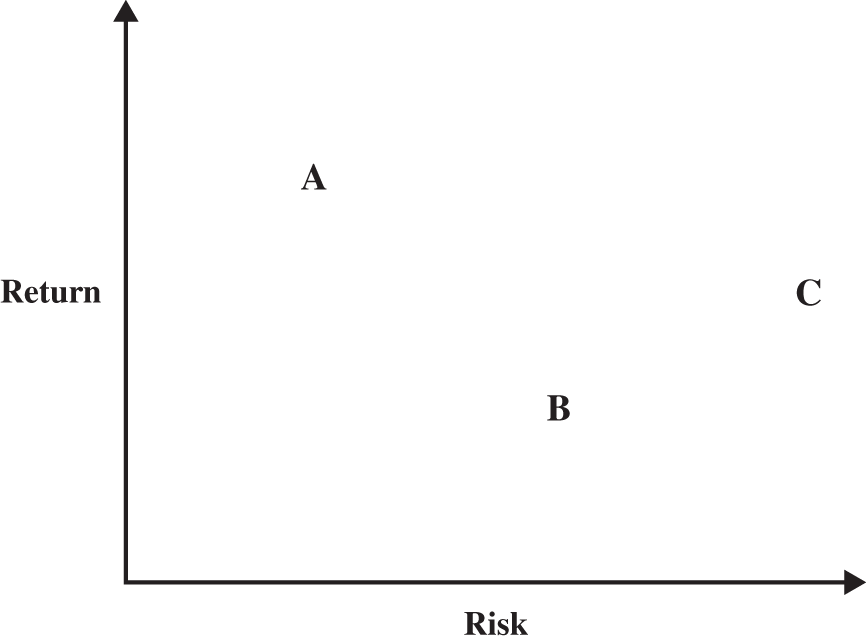

Imagine if there were only three investments in the world and we could plot their risk and return in a single chart as shown in Figure 8.1.

Figure 8.1 Chart of potential assets A/B/C.

In this simple example, investment A is the obvious choice because it is the most efficient portfolio. Investment A delivers the highest return for a unit of risk. There is no reason to choose investment B or investment C because they have much higher risk for less return.

Creating Money Under the Credit Theory of Money

Let's begin with some simple assumptions. The only ...

Get Money Without Boundaries now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.