2Vector time series models

Although as shown in Chapter 1, a stationary vector time series process Zt that is purely nondeterministic can always be written as a moving average representation, and an invertible vector time series process can always be written as an autoregressive representation; they involve an infinite number of coefficient matrices in the representation. In practice, with a finite number of observations, we will construct a time series model with a finite number of coefficient matrices. Specifically, we will present VMA(q), VAR(p), VARMA(p, q), and VARMA(p, q) × (P, Q)s models in this chapter. After introducing the properties of these models, we will discuss their parameter estimation and forecasting. We will also introduce the concept of multivariate time series (MTS) outliers and their detections. Detailed empirical examples will be given.

2.1 Vector moving average processes

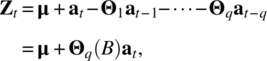

The m‐dimensional vector moving average process or model in the order of q, shortened to VMA(q), is given by

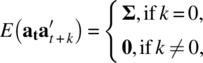

where Θq(B) = I − Θ1B − ⋯ − ΘqBq, at is a sequence of the m‐dimensional vector white noise process, VWN(0, Σ), with mean vector, 0, and covariance matrix function

and Σ is a m × m symmetric positive‐definite matrix. The VMA(q) model is clearly stationary with the mean ...

Get Multivariate Time Series Analysis and Applications now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.