CHAPTER 8How to Add Value Through Research

As we explain in the previous three chapters, if the wisdom of crowds is functioning properly, then the stock price will fully reflect all available information and be a close approximation of the company’s true intrinsic value. As a result, there will be no mispricing to exploit and no opportunity to outperform with this investment.

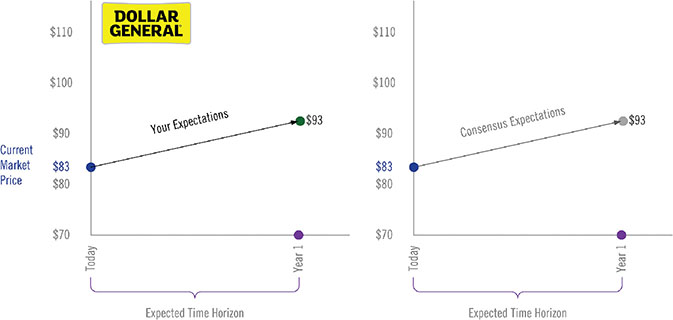

Take as an example Dollar General when the stock was trading in mid-2016 at $83 per share. The consensus estimate of the 21 sell-side analysts who followed the stock at the time was a one-year price target of $93, implying a 12% return. If you are researching Dollar General as a potential idea, unless you can identify a mispricing, your estimate of the company’s intrinsic value would match consensus expectations, as shown in Figure 8.1.

Figure 8.1 Dollar General One-Year Price Targets Without Mispricing

To identify a mispricing in a particular security, however, you must find a situation where there is a breakdown in one or more of the three tenets of market efficiency:

- Dissemination—There is information the market is missing.

- Processing—There is a systematic error in processing (caused by a lack of diversity or breakdown of independence).

- Incorporation—There is something preventing information from being incorporated in the stock price (trading is limited because of liquidity or other institutional ...

Get Pitch the Perfect Investment now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.