CHAPTER FIVE

M&A process

This section examines the process challenges that need to be addressed to deliver a successful M&A project.

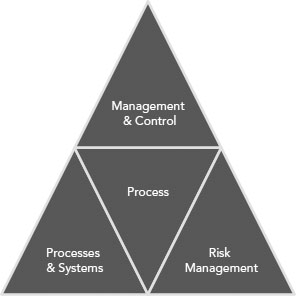

FIGURE 5.1 M&A process pyramid

RISK MANAGEMENT

M&A is change management in the ‘Major League’. Success requires the elimination, and where that is not possible overcoming the impact, of the various risks the organisation faces. The fundamental method to address this is to implement effective risk management. This is addressed later in the section on risk management in ‘Planning, management and control’ on page 106. However, before that we will look at how you identify the risks the organisation is facing, and how you understand the determinants of risk behaviour that will be exhibited by your people and organisation. A few years ago I conducted research into this to explore these questions.

In the following pages I will firstly examine what are the determinants of risk behaviour. Then I will describe a cognitive technique which has been used since in a number of organisations to identify and prioritise the risks they face.

Determinants of risk behaviour

The first thing to understand is that for most organisations the state of transition and change that is a merger or acquisition is something they are not normally engaged in. There are, of course, some notable exceptions to this. M&A deals typically present organisations with problems which they ...