Topic 2

M&A Process: Front to Back

This topic and Appendix 2.1 present an overview of the M&A process activity and stages typical of most corporate development processes. Auction M&A transactions, which share most of the activities presented but on a more compressed timeline, are covered in Topic 12.

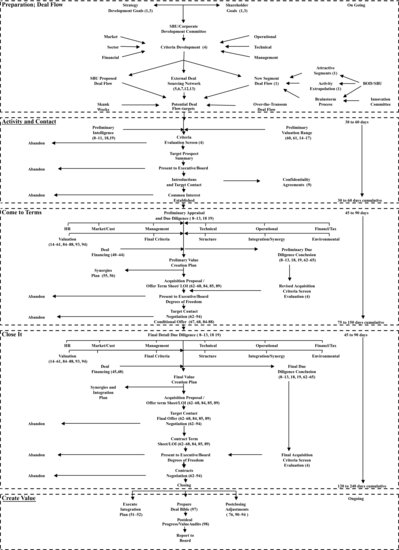

APPENDIX 2.1 M&A Process Activity and Stages Map (Topic Reference)

The reader is encouraged to take the time to read through the sequential time line of activities on Appendix 2.1 to gain a feel of the flow of events. Topic numbers are listed in parentheses next to each activity that is expanded on in the text that follows.

DEFINITION OF THE M&A PROCESS

- Preparation. Deal flow starts with strategy development and development of target acquisition criteria (see Topic 4) and runs through creation of deal flow.

- Acquisition criteria are developed in a collaborative process that attempts to capture the qualitative and quantitative attributes of attractive target markets and target companies. They are used as a screen to rule target candidates out or in.

- Deal flow can emanate from internal sources, including research and development, sales and marketing, corporate development efforts, and programs such as activity extension and brainstorming and external efforts, such as mandated investment banks, targeted searches, over-the-transom offerings, or competition.

- Activity and Contact. This ...