Topic 54

Discount Rates and Valuing Free Cash Flow

Topic 53 explores the variety of assumptions that can be made regarding when an annual cash flow amount is received during the year (beginning, end, middle) and the computational adjustments required to the nominal discount rate to properly reflect the impact of the timing of the cash flow on the cash flow valuation.

OVERVIEW

- Discount rates can reflect very different assumptions regarding the timing of the receipt of free cash flow (FCF) during an annual period. Discount rates are computationally adjusted to reflect the timing assumption. Valuation results vary significantly depending on the discount rate construction.

YEAR-END DISCOUNT RATES

- Discount rates in many discounted cash flows (DCFs) or perpetuity DCF calculations are often stated as (and generally known as) year-end rates.

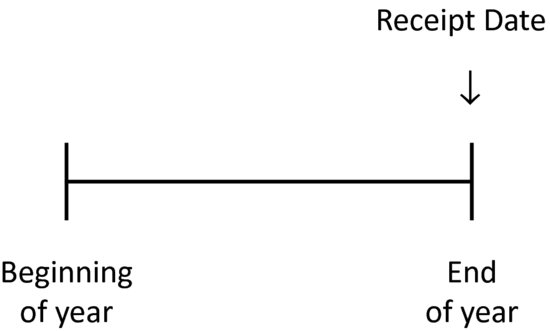

- Year-end discount rates by convention value the stated annual cash flow amount in the DCF as if it occurs at the last moment on the last day of each annual period (N) as shown next:

- Year-end discount rates are determined as shown for any year N:

where

r = annual discount rate N = year 1, 2, 3 …

- The end-of-year basis discount rate convention will result in the smallest valuation versus the other conventions as the cash is presumed to be received ...

- Year-end discount rates are determined as shown for any year N: