209

15

Severity Modelling: Adjusting for

IBNER and Other Factors

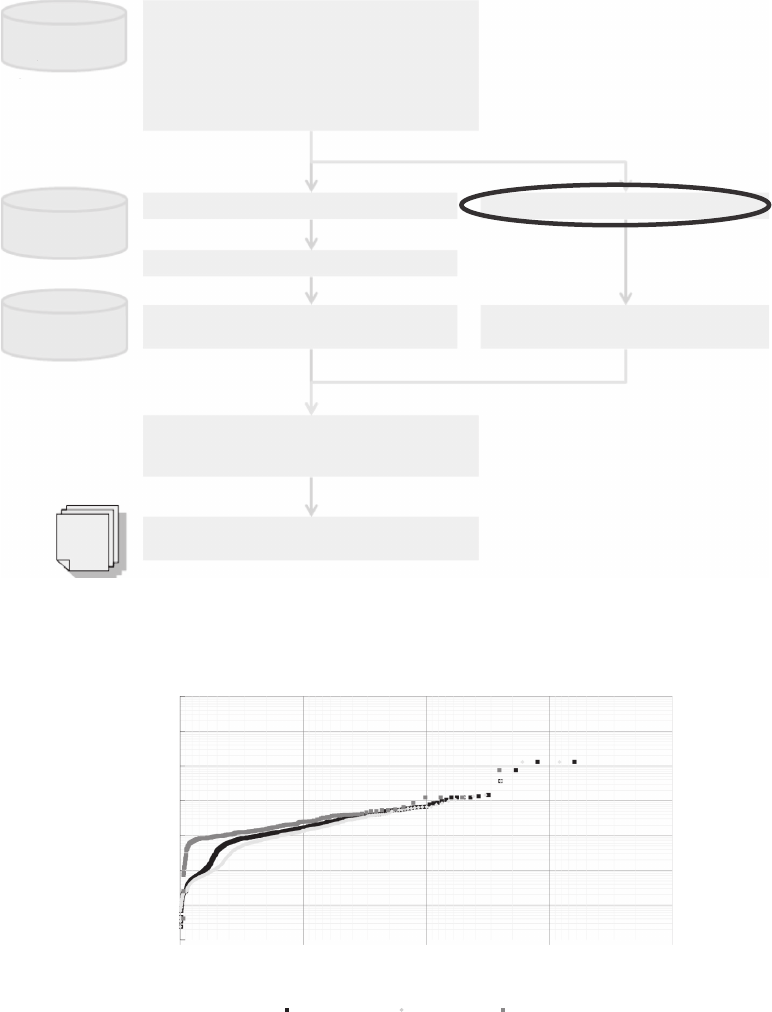

Having produced a frequency model in Chapters 13 and 14, we can now explore the lower

‘branch’ of the pricing process (Figure 15.1), which aims at producing a severity model

based on the past loss experience of the portfolio under investigations and possibly other

information from other relevant portfolios of risks.

15.1 Introduction

The rst problem that we need to address is that many of the losses that we may use to

estimate the overall distribution of losses (the ‘severity distribution’) are not nal settled

values but estimates, as they are composed of a paid and an outstanding component, and

the outstanding reserve is an estimate of what the remaining amount will be.

The difference between the nal settled amount and the overall estimate (paid + out-

standing) is called the ‘IBNER’ (incurred but not enough reserved – or sometimes, bizarrely,

incurred but not enough reported) amount.

Naturally, if the policy of the company is to set reserves neutrally and is competent

at that, you expect errors to average out and systematic IBNER to be zero. However, if

reserves systematically overestimate or underestimate the loss amount, then one needs to

correct for IBNER. IBNER will be positive if the reserves are underestimated, and negative

if they are overestimated.

How do we know if there is a systematic error? Ideally, we should have the complete

history of all reserve estimates and how they change in time. Large losses are typically

reviewed at regular intervals and the reserve is updated if any new fact emerges. With

small losses, this is less likely, but they will still be given a temporary amount according

to some company protocol and they will then be updated when they are settled. In both

cases, a good strategy would be to compare the estimated amounts with the nal one.

Even if we do not have the reserving history, we may still have for each claim the amount

reserved and the information on whether it is closed or paid (either stated explicitly or

implicitly by looking at whether a percentage of the amount incurred is still outstanding).

In this case, a comparison of the severity distribution of the closed/settled claims with the

distribution of the open claims may be interesting.

We have done exactly this for our case study and have shown the results in Figure

15.2. In this gure, we are comparing the distribution of settled claims (where the deni-

tion of settled was ‘more than 95% paid’) with the distribution of the non-settled claims.

Obviously, the two distributions are, in this case, quite different, and the main difference

is that non-settled claims seem much larger than settled claims.

210 Pricing in General Insurance

Individual

loss data

Assumptions on

– Loss inflation

– Cu

rrency conversion

– …

Exposure

data

Portfolio/market

information

Data preparation

– Data checking

– Data cleansing

– Data transformation

– Claims revaluation and currency conversion

– Data summarisation

– Calculation of simple statistics

Inputs to frequency/severity analysis

Adjust historical claim counts for IBNER

Adjust for exposure/profile changes

Select severity distribution and

calibrate parameters

Select frequency distribution and

calibrate parameters

Adjust loss amounts for IBNER

Severity model

Frequency model

Estimate gross aggregate distribution

e.g. Monte Carlo simulation, Fast Fourier

transform, Panjer recursion…

Gross aggregate loss model

Ceded/retained aggregate loss model

Allocate losses between (re)insurer and

(re)insured

Cover

data

FIGURE 15.1

This gure shows how IBNER analysis ts within the pricing process.

10

100

1000

10,000

100,000

1,000,000

10,000,000

100,000,000

0.01

%

0.10%1.00%10.00%100.00%

Amount [€]

All losses Settled Non-settled

Exceedance probability

FIGURE 15.2

Each dot in this graph represents a loss. The graph is to be read as follows: for settled (light grey) losses, for

example, there are roughly 1% of losses that are above €100K. The graph shows that non-settled (medium grey)

losses are usually bigger than the settled losses, especially in the small–medium loss range. This has quite a

large effect on the mean: non-settled claims have a mean of €14K compared with €8K for settled losses.

Get Pricing in General Insurance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.