SOLUTION TO EXERCISE G-3

Explanation: If a lease meets any one of the following criteria, it is classified as a capital lease:

- The lease transfers ownership of the property to the lessee. Rationale: If during the lease term, the lessee receives ownership of the asset, the leased asset should be reported as an asset on the lessee's books.

- The lease contains a bargain purchase option. Rationale: If during the term of the lease, the lessee can purchase the asset at a price substantially below its fair market value, the lessee will obviously exercise this option. Thus, the leased asset should be reported on the lessee's books.

- The lease term is equal to 75% or more of the economic life of the leased property. Rationale: If the lease term is for much of the asset's useful life, the asset should be recorded on the lessee's books.

- The present value of the lease payments equals or exceeds 90% of the fair market value of the leased property. Rationale: If the present value of the lease payments is equal to or almost equal to the fair market value of the asset, the lessee has essentially purchased the asset. As a result, the leased asset should be recorded on the books of the lessee.

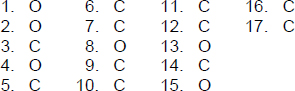

A capital lease is recorded on the books of the lessee by the following journal entry:

![]()

The leased asset is ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.