SOLUTION TO EXERCISE 10-6

Explanation:

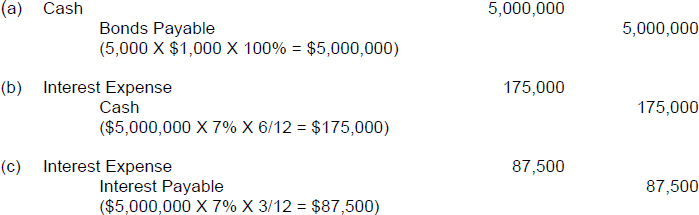

- The 5,000 bonds each have a face (par) value of $1,000. Each bond is issued at a price of 100 which means 100% of the face value (100% × $1,000 = $1,000 each). Therefore, cash of $5,000,000 is received and the company records a liability called Bonds Payable.

- Interest is a function of balance (face value in this case), interest rate, and time. The amount of time that lapsed between the issuance date of April 1, 2014 and the interest payment date of October 1, 2014 is six months. The interest rate is the stated rate of 7%. The interest paid is recorded as a credit to Cash and a debit to Interest Expense (because none of the interest was previously accrued).

- When an accounting period ends on a date other than an interest payment date, the interest accrued since the last interest payment date is recorded by a debit to Interest Expense and a credit to Interest Payable. This adjustment is necessary to get interest expense recorded in the proper time period (matching principle). The number of months between July 1 and October 1 is 3.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.