SOLUTION TO EXERCISE 10-13

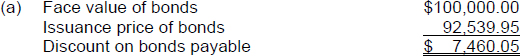

TIP: An excess of face value over issuance price results in a discount.

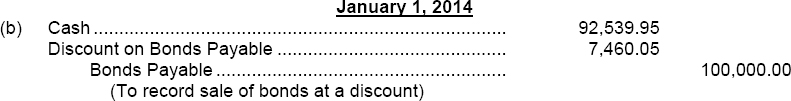

Approach and Explanation: Always start with the easiest part of a journal entry. The issuance of a bond is always recorded by a credit to the Bonds Payable account for the face value of the bonds ($100,000 in this case). Because the issuance price is less than face, a contra type valuation account must be established; it is titled Discount on Bonds Payable and is debited for the issuance discount of $7,460.05. Cash was received for the issuance price so debit Cash for the proceeds of $92,539.95.

TIP: The Discount on Bonds Payable account is sometimes called Unamortized Bond Discount. Regardless of whether the word unamortized appears in the account title or not, the balance of this account at a balance sheet date (after adjustments) represents the unamortized amount.

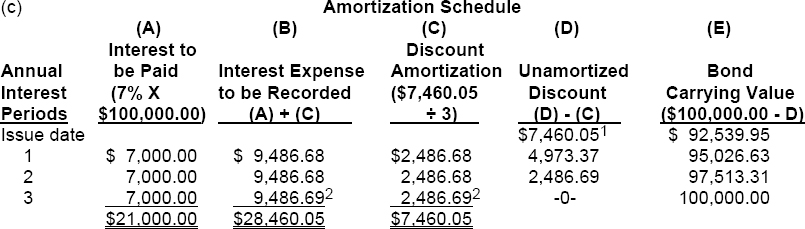

1Face value ($100,000.00) minus the issuance price ($92,539.95) = Discount on issuance ($7,460.05).

2Any rounding errors are plugged to (included in) the interest expense amount for the last period. Otherwise, there would forever be a small balance left in the Discount on Bonds Payable account long after the bonds were ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.