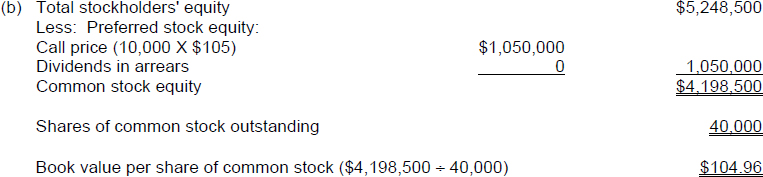

SOLUTION TO EXERCISE 11-13

(a) The book value per share of preferred stock is $105—the call price per share.

Explanation: The preferred stock equity per share consists of the call price of the stock plus any dividends in arrears. If the preferred stock does not have a call price, the book value of one share of preferred is equal to the preferred's par value plus any dividends in arrears.

TIP: Notice that none of the paid-in capital in excess of par value arising from the issuance of preferred stock at a price above par ($120,000) is directly allocated to preferred stock in the book value per share of preferred stock computation.

TIP: There is no mention of any dividends in arrears for this entity at the specified balance sheet date.

TIP: If only one class of stock is outstanding, the book value of common is computed simply by dividing total stockholders' equity by the total number of shares outstanding.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.