SOLUTION TO EXERCISE 12-5

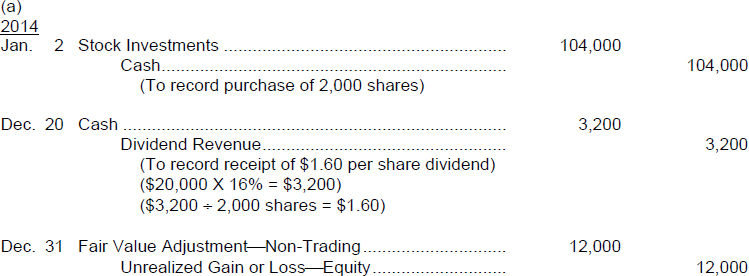

TIP: At December 31, 2014, the market value of the non-trading securities (2,000 × $58 exceeds their cost ($104,000); hence, a valuation account with a $12,000 ($116,000 $12,000) balance is necessary to report the securities at fair value on the balance sheet.

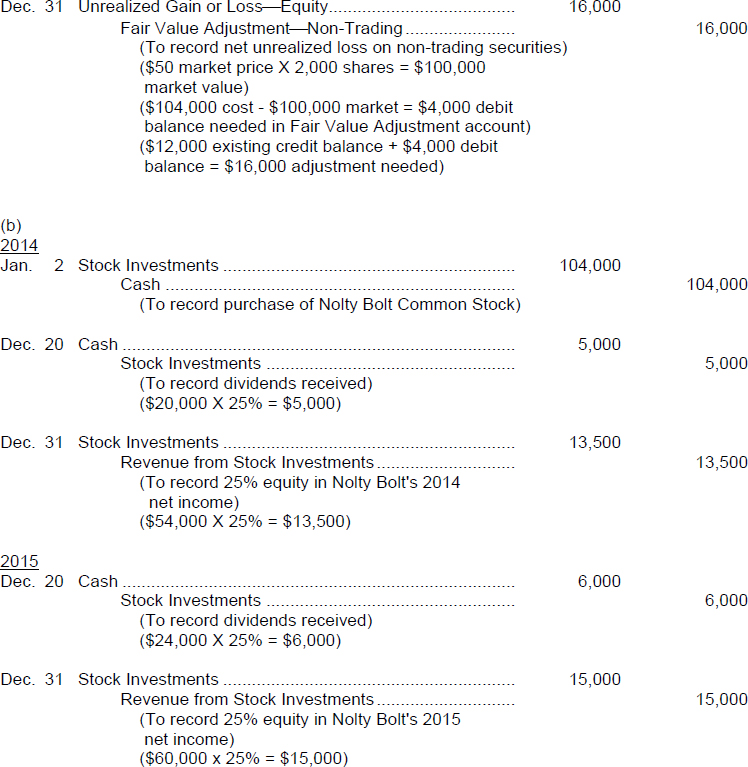

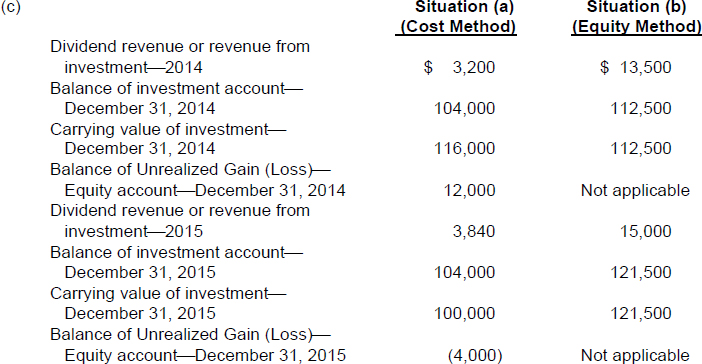

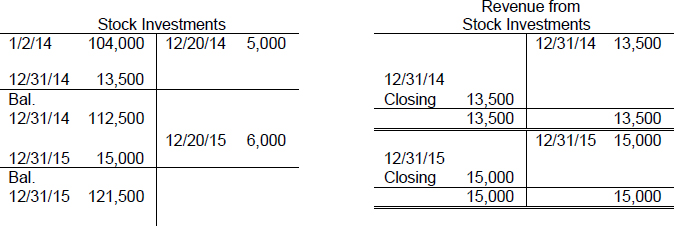

Approach and Explanation for Situation (b): Draw T-accounts for the investment and the investment revenue accounts. Enter the amounts as they would be posted to those accounts from the entries in (b) above.

Explanation: When an investor has significant influence over an investee, the investor should use the equity method of accounting for the investment. When an investor does not have significant influence, the investor should use the cost method. When an investor owns 20% or more of the outstanding common stock of the investee, it is presumed that the investor has significant influence unless there is evidence to the contrary. (When one corporation owns more than 50% of another corporation, consolidated ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.