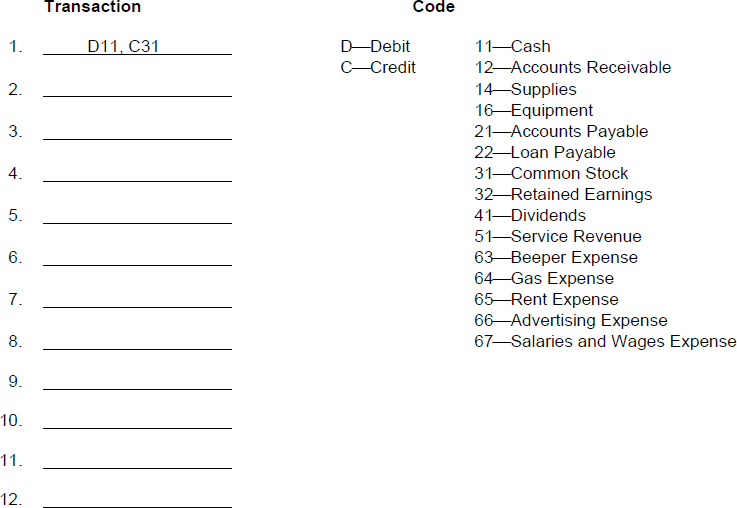

EXERCISE 2-2

| Purpose: | (L.O. 2, 4) This exercise will give you practice in applying the debit and credit rules. |

A list of transactions appears below:

- Dan Harrier invested $1,000 cash in a new business, Luxury Detailing, in exchange for common stock.

- Purchased equipment for $600 cash.

- Purchased $300 of supplies on account.

- Rented a vehicle for the month and paid $250.

- Paid $100 for an ad in a local newspaper.

- Purchased gas for $20 on credit.

- Sold services for $200 cash.

- Sold services for $300 on account.

- Paid $90 wages for an assistant's work.

- Declared and paid a cash dividend of $80.

- Paid for use of beeper service, $30.

- Borrowed $2,000 from the Cash-N-Carry Bank in anticipation of expanding the business.

Instructions

Indicate how you would record each transaction. What account would you debit and what account would you credit? Use the appropriate code designation. The first transaction is coded for you.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.