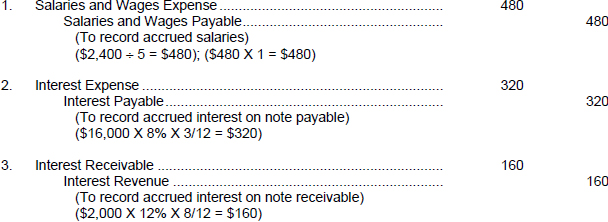

SOLUTION TO EXERCISE 3-1

TIP: An interest rate is an annual rate unless otherwise indicated. For preparing an adjusting entry involving interest, compute interest assuming the rate given is for a whole year, unless it is evident that this is not the case. Also, assume a 360 day year, unless otherwise indicated.

![]()

Explanation: An accrued expense is an expense that has been incurred but not paid. The “incurred” part results in an increase in Expense (debit) and the “not paid” part results in an increase in Payable (credit). An accrued revenue is a revenue for which services have been performed but the related cash has not been received. The “performed” part results in an increase in Revenue (credit) and the “not received” part results in an increase in Receivable (debit).

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.