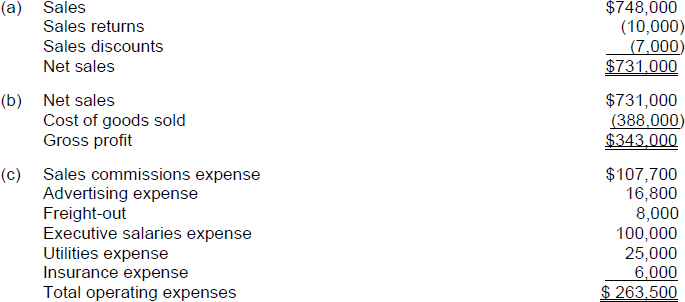

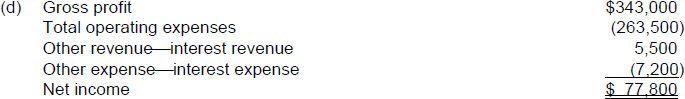

SOLUTION TO EXERCISE 5-1

Explanations:

Approach for parts (a), (b) and (d): Write down the elements of the computations for net sales, gross profit, and net income. Refer to Illustration 5-1. Enter the data given and solve.

TIP: Some companies subdivide the operating expenses into the two major subclassifications of selling expenses and administrative expenses. Administrative expenses are often called general and administrative expenses. Selling expenses include expenses associated with the making of sales, such as salaries for the sales force, sales commissions, advertising, freight, delivery, and depreciation of sales counters, showroom, and store equipment. General and administrative expenses include expenses relating to general operating activities such as rent, officer salaries, personnel management, insurance, accounting, and store security.

TIP: Nonoperating items include other revenues, other gains, other expenses, and other losses.

![]()

ILLUSTRATION 5-2 DAILY RECURRING AND ADJUSTING AND CLOSING ENTRIES FOR A MERCHANDISING ENTITY USING A PERPETUAL INVENTORY SYSTEM (L.O. 2, 3, 4)

The following are the typical entries for a merchandising entity employing a perpetual inventory ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.