ANALYSIS OF MULTIPLE-CHOICE TYPE QUESTIONS

- (L.O. 3) The journal entry to record the write-off of an individual customer's account receivable using the allowance method involves a debit to:

- Allowance for Doubtful Accounts and a credit to Accounts Receivable.

- Bad Debt Expense and a credit to Accounts Receivable.

- Accounts Receivable and a credit to Allowance for Doubtful Accounts.

- Bad Debt Expense and a credit to Allowance for Doubtful Accounts.

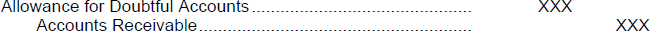

Approach and Explanation: Write down the journal entry to record the write-off of an individual customer's account:

Find the answer selection that describes this entry. Answer selection “d” describes the journal entry to record bad debt expense and to adjust the allowance account. (Solution = a.)

- (L.O. 3) The balances of the Accounts Receivable account and Allowance for Doubtful Accounts account, before adjustment, are $60,000 and $1,200 respectively. Bad debt expense for the period is estimated to be $3,100. What amount should be reported for net accounts receivable on the balance sheet?

- $58,100.

- $58,800.

- $56,900.

- $55,700.

Approach and Explanation: One approach is to draw T-accounts, enter the balances before adjustment, reflect in the accounts the entry to record bad debt expense, balance the accounts, and deduct the balance of the contra account from the balance of the Accounts Receivable account to determine net accounts receivable ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.