SOLUTION TO EXERCISE 9-4

(c) Depreciation is the accounting process of allocating an asset's historical cost (recorded amount) to the accounting periods benefited by the use of the asset. It is a process of cost allocation, not valuation. Depreciation is not intended to provide funds for an asset's replacement; it is merely an application of the matching principle.

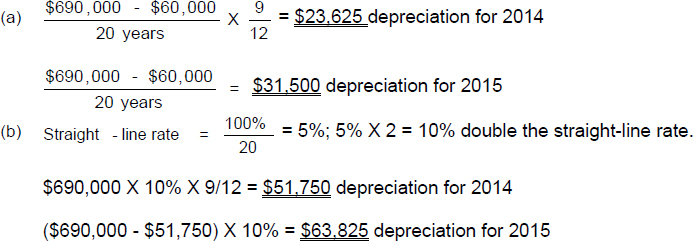

Approach and Explanation:

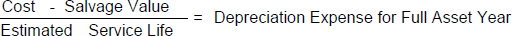

- Write down and apply the formula for straight-line depreciation. Then multiply the annual depreciation amount by the portion of the asset's year of service that falls in the given accounting period.

Only nine months of the first asset year falls in 2014 so the fraction 9/12 (or 3/4) must be applied to the annual depreciation amount calculated to arrive at the depreciation expense for the income statement for 2014.

- Write down and apply the formula for the declining-balance method.

Book Value

at Beginning X Constant Percentage = Depreciation for Asset Year

of Asset Year

Only nine months of the first asset year falls in 2014 so the fraction of 3/4 must be applied to the annual depreciation amount calculated to arrive at the depreciation for the income statement for 2014.

After the first partial year, depreciation can be calculated for a full accounting year by multiplying the constant percentage ...

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.