SOLUTION TO EXERCISE 9-7

Explanations:

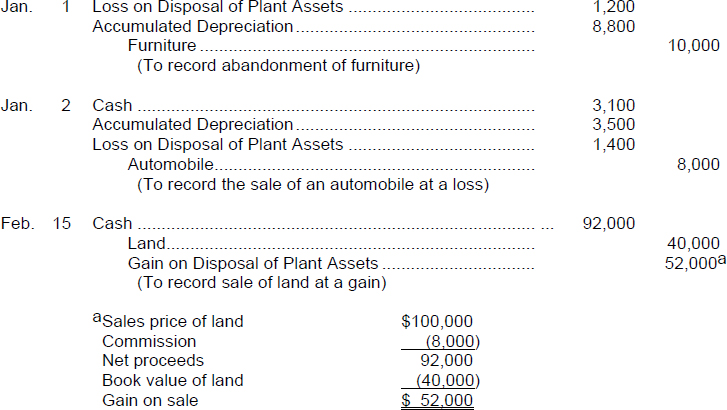

Furniture. There is no salvage (residual) value; hence, the book value ($1,200) is written off as a loss.

Automobile. The book value ($8,000 - $3,500 = $4,500) is removed from the accounts. The cash recovered ($3,100) is recorded. The book value exceeds the cash; therefore, a loss is recorded for the difference.

Land. The book value ($40,000) is removed from the accounts. The net proceeds ($100,000 - $8,000 = $92,000) is recorded. The commission is a cost of the disposal rather than an operating expense; hence, it is a reduction of the gain or increase in the loss on disposal. (In this case, it is a decrease in gain.) The excess of the net proceeds ($92,000) over the book value ($40,000) is recorded as a gain.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.