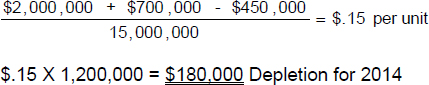

SOLUTION TO EXERCISE 9-8

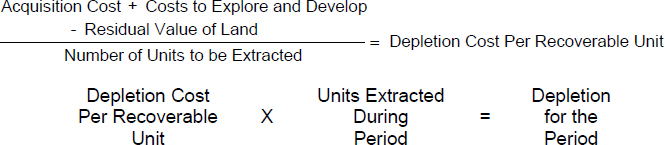

Approach and Explanation: Write down the formulas to compute depletion, enter the data given, and solve.

TIP: The depletion cost is the amount to be removed from the property, plant, and equipment classification ($180,000 in this case). It is based on the units extracted from the earth during the period. The portion of this $180,000 which appears on the income statement is dependent upon the number of units sold. The depletion costs related to units sold—depletion expense—is classified as part of cost of goods sold expense on the income statement. When the number of units extracted exceed the number sold, a portion of the depletion costs goes into the inventory account on the balance sheet.

Get Problem Solving Survival Guide to accompany Financial Accounting, 8th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.