- 9. Pricing a Security Derivative. Consider an economy consisting of a risk-free asset and a stock price (risky asset). At time

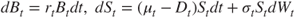

, the risk-free asset

, the risk-free asset  and the stock price

and the stock price  have the following diffusion processes

have the following diffusion processes

where

is the risk-free rate,

is the risk-free rate,  is the continuous dividend yield,

is the continuous dividend yield,  is the stock price growth rate,

is the stock price growth rate,  is the stock price volatility (which are all time dependent) and

is the stock price volatility (which are all time dependent) and  is a

is a  -standard Wiener process on the probability space .

-standard Wiener process on the probability space .At time , we consider a trader who has a portfolio valued at holding ...

Get Problems and Solutions in Mathematical Finance: Stochastic Calculus, Volume I now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.