Chapter 7A Closer Look at the United StatesThe U.S. Problem Becomes the World's Problem

Where Are We Now?

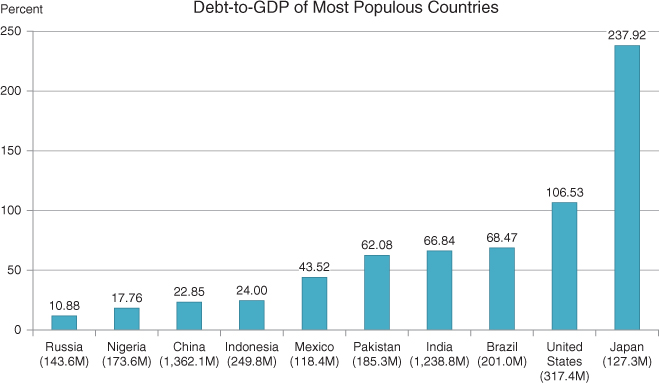

According to the International Monetary Fund, the United States has a serious debt to gross domestic product (GDP) comparison problem. We are also a significant debtor nation compared with other populous nations. In fact, the United States is the second-highest-ranking debtor nation on Figure 7.1, which measures the amount of federal debt as a percentage of GDP.

Figure 7.1 How the United States Compares to Other Nations

Data note: Data for Bangladesh (eight most populous country) unavailable.Source: International Monetary Fund.

Sadly, the problem is only going to get significantly worse, not better. The U.S. Congressional Budget Office (CBO), a group that uses current laws and trends to make predictions, foresees the U.S. debt level approaching Japan's by 2038. As discussed in the previous chapter, this will mean a need for more taxes, spending cuts, borrowing—or some combination of the three. Even without more borrowing, higher interest rates are going to put a lot of pressure on the federal budget. Corporate tax rates in 2013 in the United States were nominally the highest in the industrialized world.1 We can reasonably expect that rising tax rates further on businesses could affect business formations and capital expenditures negatively here in the United States and ...

Get Prosperity in The Age of Decline: How to Lead Your Business and Preserve Wealth Through the Coming Business Cycles now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.