Fama-French three-factor model

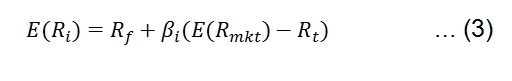

Recall that the CAPM has the following form:

Here, E() is the expectation, E(Ri) is the expected return for stock i, Rf is the risk-free rate, and E(Rmkt) is the expected market return. For instance, the S&P500 index could serve as a market index. The slope of the preceding equation (![]() ) is a measure of the stock's market risk. To find out the value of

) is a measure of the stock's market risk. To find out the value of ![]() , we run a linear regression. The Fama-French three-factor model could ...

, we run a linear regression. The Fama-French three-factor model could ...

Get Python for Finance - Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.