Chapter 16. Job Estimating, Billing, and Tracking

In This Chapter

Turning on job costing and setting up jobs

Creating estimates and estimate-based invoices

Charging for time and out-of-pocket expenses

Comparing budgeted, estimated, and actual job information

QuickBooks Pro and QuickBooks Premier have a feature that's very interesting for businesspeople — such as contractors, consultants, engineers, and architects — who do jobs or projects for their customers. QuickBooks Pro and QuickBooks Premier have the capability to do simple project or job costing. This capability means that your business can create project or job estimates, track costs by project or job, and bill invoices by project or job.

In this short chapter, I describe the QuickBooks job costing feature.

Turning On Job Costing

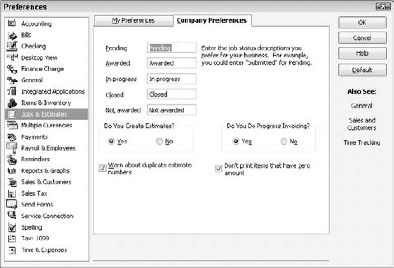

To turn on the job costing or estimating feature in QuickBooks, choose Edit

Note: Progress billing or progress invoicing refers to the practice of billing or invoicing a client or customer as work on a project progresses. In other words, rather than invoice at the very end of a project, you might bill half the agreed-upon amount when work is roughly half done. And then you might bill the remaining half of the agreed-upon amount when the work is finally finished.

Figure 16.1. The Company Preferences tab showing ...

Get QuickBooks® 2010 For Dummies® now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.