Selling a Depreciable Asset

Selling a depreciable asset works almost identically to selling an asset that you haven’t been depreciating. When you sell the asset, you need to back out the asset’s account balance. You also need to back out the asset’s accumulated depreciation (which is the only thing that’s different from selling an asset that you haven’t been depreciating). You need to record the cash (or whatever) that somebody pays you for the asset. Finally, you count as a gain or a loss any difference between what you sell the asset for and what its net-of-accumulated-depreciation (or book value) is.

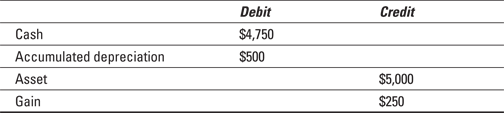

To record the sale of this depreciable asset, you’d use the following journal entry:

Get QuickBooks 2013 For Dummies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

This process sounds terribly complicated, but an example helps. Suppose that you purchased a $5,000 piece of machinery and have accumulated $500 of depreciation thus far. Consequently, the asset account shows a $5,000 debit balance, and the asset’s accumulated depreciation account shows a $500 credit balance. Suppose also that you sell the machinery for $4,750 in cash.

This process sounds terribly complicated, but an example helps. Suppose that you purchased a $5,000 piece of machinery and have accumulated $500 of depreciation thus far. Consequently, the asset account shows a $5,000 debit balance, and the asset’s accumulated depreciation account shows a $500 credit balance. Suppose also that you sell the machinery for $4,750 in cash. As I note earlier in the chapter, if you have a bunch of assets, you probably want to set up individual accounts for each asset’s original ...

As I note earlier in the chapter, if you have a bunch of assets, you probably want to set up individual accounts for each asset’s original ...