CHAPTER 6Flash Crashes

- —Who do you call when the markets are in a panic?

- —Your system administrator.

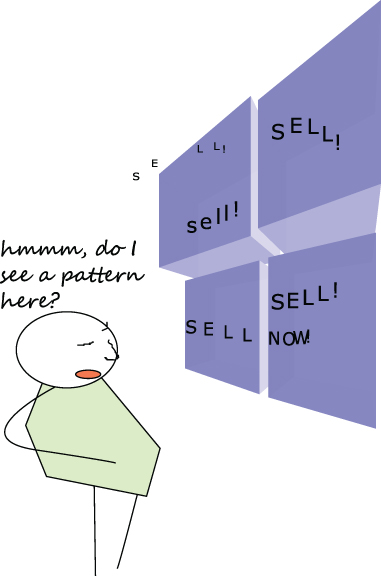

Nothing shouts real‐time risk like seeing a stock's price plummet for no apparent reason. How is it possible that on a day when there isn't much news to speak of, a stock's value can crater? Sometimes the entire market collapses, but often the crashes are contained to individual stocks. At times, the price recovers during the day, prompting investors to ask about the causes of this phenomenon. This chapter describes the spanner in the works.

A flash crash is a significantly negative intraday return coupled with high intraday volatility, collectively known as severe downward volatility. A flash crash does not necessarily span multiple financial instruments; it may affect only one stock, bond, or futures contract.

To complicate matters further, high volatility alone does not guarantee a crash. For a highly volatile day to become a crash day, the price of the asset under consideration has to significantly drop. Few investors can be heard complaining about flash rallies, when the price is driven significantly higher intraday.

Likewise, a steep intraday loss alone may just be considered a “crash” and may or may not constitute a “flash” crash. Most market events commonly considered to be flash crashes are characterized by a sharp reversal or correction of prices. For example, during ...

Get Real-Time Risk now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.