CHAPTER 10Why Venture Capitalists Are Betting on Fintech to Manage Risks

The innovations in real‐time risk surveillance and management present us with opportunities that were previously unthinkable. As a broker‐dealer, you can understand factors behind your customers' performance in real time. As an investor, you can pick and choose broker dealers and avoid being pigeonholed based on your performance. Recent advances in transaction cost analytics deliver a powerful set of real‐time and near‐real‐time risk metrics and analyses.

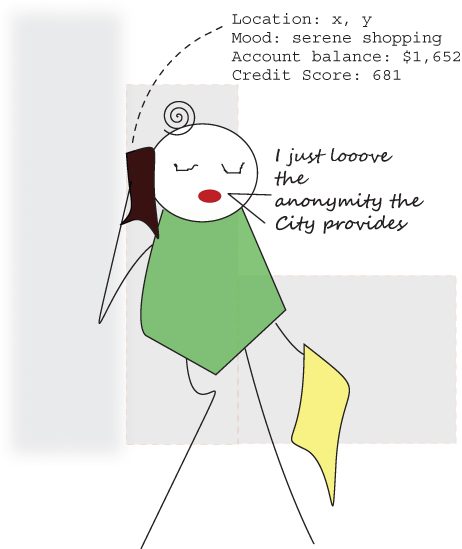

Fintech companies are changing business as usual for many established financial services companies. Firms like Money.net are threatening to undermine the decades‐long dominance of Bloomberg. Companies like Virtu are electronically making markets. Disruptors like Kensho are automating financial research by enabling natural‐language Google‐style queries to replace the traditional way that research is done with immediate online access to information any analyst needs. Online lending platforms are coming out of the woodwork, directly competing with 100‐year‐old banks. Money transfer firms are taking on established wire operations. All sorts of traditional financial intermediation, trading, and even research are threatened by technology upstarts.

There is no doubt that the financial disruption is driven by technology: automation, often prohibitively expensive ...

Get Real-Time Risk now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.