Investment Growth Theory

In the parallel universe of IGT, we get a different formula. I present it here to expand consciousness, not to make a serious argument for it. It has some interesting properties, and explains some things that MPT CAPM cannot. Its assumptions are no more unrealistic than those of MPT CAPM. However, it has some problems, which I won't discuss, and it also has zero empirical support. We're in a counterfactual chapter, a looking-glass world. The IGT CAPM is here to demonstrate that the MPT CAPM can become a rut that prevents its students from seeing that there are rational, even reasonable, alternatives to the MPT CAPM worldview. While the empirical evidence for CAPM is strong for large portfolios over long periods of time, that evidence cannot tell us much about smaller portfolios and shorter time periods.

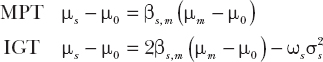

Here are both MPT and IGT CAPM equations with μ representing expected return, β the regression beta on the market portfolio, σ the standard deviation of return, ω the proportion of the value of the security to the value of the market, and subscripts s for a security, m for the market, and 0 for the risk-free asset.

The IGT CAPM results from simple assumptions and algebra. Everything is owned by somebody. We sometimes say things are owned by companies or governments, but we assume we can trace everything through to some beneficial owner who is the ultimate ...

Get Red-Blooded Risk: The Secret History of Wall Street now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.