CHAPTER 17 The 360‐Degree Risk Management Function

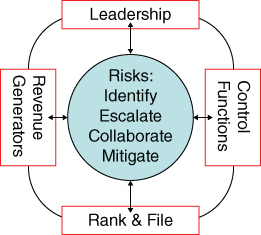

While the risk management function still has an important role to play at the vanguard of risk, the firm must organize itself to ensure that it is the overarching business that owns and manages its risks (see Figure 17-1). How effective the firm is in doing so can be a major source of competitive advantage.

Figure 17-1: All functions collaborate in identifying and managing risks

Here we look at four changes that investment banks are making to address big risk and ensuring that they have an effective risk architecture in place:

- Ensure that leadership's business strategy takes account of risks as well as rewards.

- Break down the barriers between the risk management function and business units.

- Integrate the various risk management functions.

- Upgrade the role of operational risk departments.

Tone from the Top: Assess Risks as Well as Goals

Risk Management Strategy

The right tone at the top means that firm management embraces risks as well as goals. For some firms, an understanding of risk is wrapped up in every strategy, every business decision they ever make. Take Berkshire Hathaway as an example. Warren Buffett is known for his long‐standing distaste for technology stock.1 As a consequence, Buffett has long shied away from investing in technology companies and stocks. This is an example of a firm understanding its ...

Get Rogues of Wall Street now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.