14

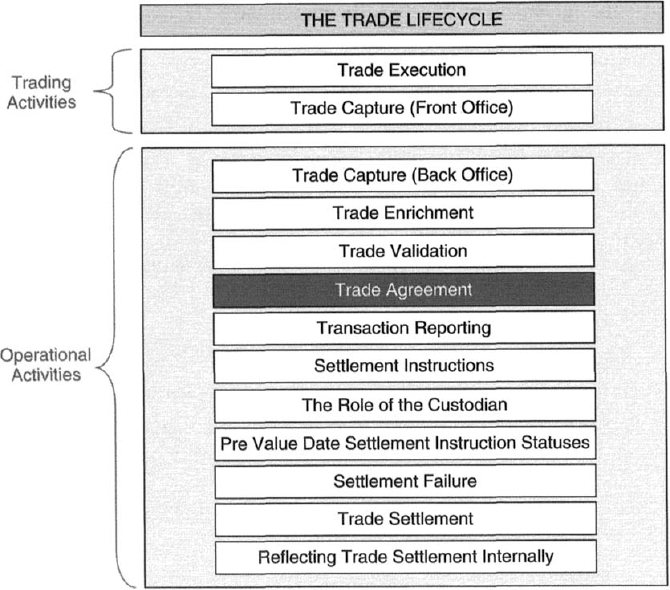

Trade Agreement

14.1 INTRODUCTION

Once a trade has passed validation, a number of actions can commence. The action that is typically regarded as being most urgent to complete is the act of gaining agreement of the trade details with the counterparty. Trade agreement is necessary in order to reduce the STO's risk.

Trade agreement can be achieved through:

- the issuance of outgoing trade confirmations to the counterparty

- the receipt of incoming trade confirmations from the counterparty

- trade matching

- trade affirmation

and each of these methods will be explained within this chapter.

In a generic sense, trade agreement is achieved by the STO communicating the details of each trade to its counterparty, whereupon the counterparty should check the detail, and revert to the STO if:

- it recognises the trade, but the details differ (e.g. the price is different), or

- it does not recognise the trade at all.

The communication needs to contain all the basic trade details as a minimum, plus the cash value calculations and, optionally, the settlement details including both the STO's and the counterparty' custodian details, their account numbers and whether the trade is to settle on a DvP or an FoP basis.

Note: the matching of seller's and buyer's trade details is, in many cases, effected through two routes, namely:

- trade agreement—the agreement of trade detail between the STO and its counterparty, ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.