20

Trade Settlement

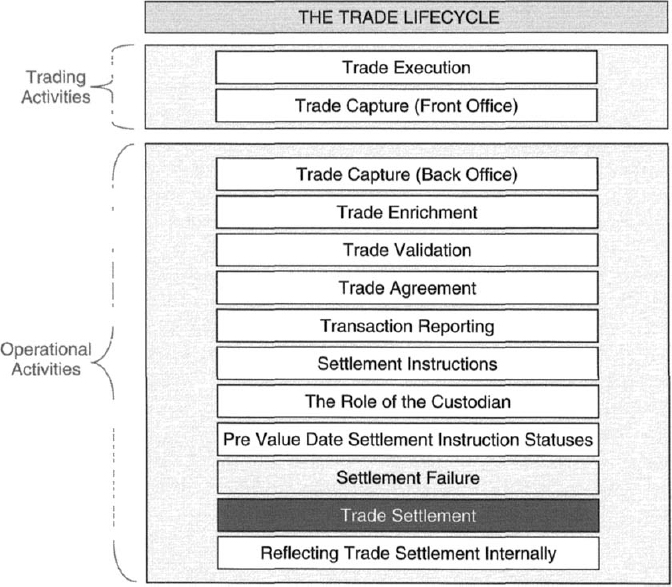

20.1 INTRODUCTION

Trade settlement is the act of exchanging securities and cash between buyer and seller. Due to the global nature of the securities industry, trade settlement typically occurs at the STO's custodians located in the various financial centres. Historically, trade settlement would have been effected by the physical delivery of certificates from seller to buyer, in exchange for cash.

In very general terms, it is to be expected that within each marketplace, the majority of trades settle on their value date (the intended date of delivery and payment, also known as the contractual settlement date), with those trades that do not settle on their value date settling at any later point in time. The date that the exchange of securities and cash is effected is known as the settlement date, or ‘actual settlement date’.

20.2 ENABLING TRADE SETTLEMENT

In order to maximise efficiency and to minimise costs in relation to the act of settling trades, the following actions may be taken by STOs.

20.2.1 Sales

Providing the seller holds the relevant quantity of securities within the specific account from which delivery of securities is to occur, by the time the custodian operates its settlement processing on value date, settlement will occur (providing the buyer has the cash to pay). If the seller is in a position to deliver the securities but the buyer cannot pay, ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.