26

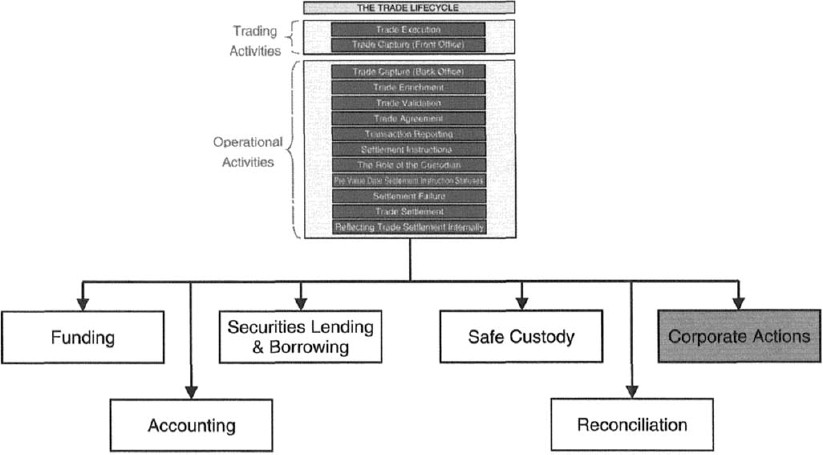

Corporate Actions

26.1 INTRODUCTION

If and when the issuer of an existing security distributes benefits to shareholders or bondholders, or chooses to change the security's structure, such events are commonly known as corporate actions.

Because corporate actions are events that occur on a security, they are relevant to all holders of the security, including STOs holding proprietary trading positions, and safe custody clients with positions managed by STOs.

The STO's main objective as far as any corporate action is concerned is to ensure that all benefits due to it and to its safe custody clients are collected in full and at the earliest available time, and that the result of changes to the structure of a security are reflected correctly within the STO's proprietary and safe custody books and records.

Because the nature of corporate actions differs, this chapter is split into three main sections: Benefits, Reorganisations and Multifaceted Actions, followed by a general section (applicable to all three) and summary.

All corporate action events can be classified as either mandatory or voluntary, where:

- participation by the owner in mandatory events is compulsory, but the owner may or may not be given an option to select its form, and

- participation by the owner in voluntary events is initiated by the owner.

Due to the fact that a number of terms used within this chapter have been ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.