27

Reconciliation

27.1 INTRODUCTION

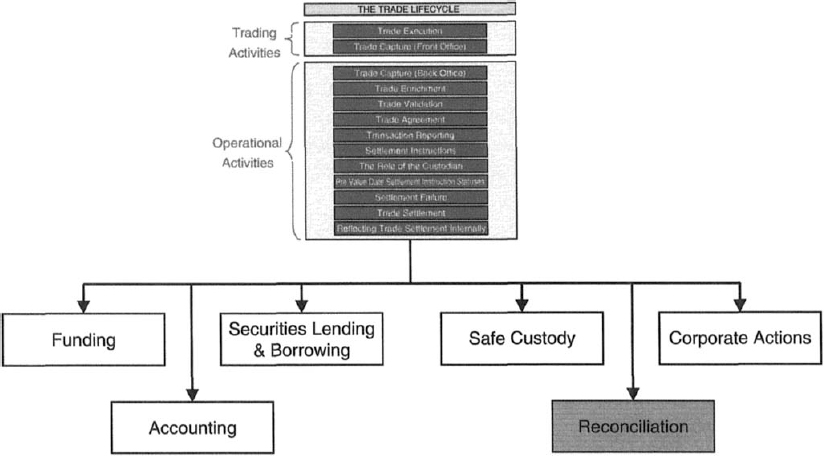

The process of proving that an STO's books and records are accurate is commonly known as reconciliation. From any perspective, reconciling positions and trades within internal books and records with the outside world is paramount in ensuring that the STO remains in control of its assets and liabilities.

In the first chapter of this book, it was stated that a company remaining in control of its goods and cash is fundamental to successful and efficient operation of its business through maintaining up-to-date internal records of:

- trades

- trading positions

- open trades

- settled trades

- settled positions

thereby enabling the prediction of future goods and cash flows, which in the case of an STO in turn enables:

- funding costs to be minimised through efficient funding projection, repo and securities borrowing activity, and

- income to be maximised through the efficient lending of securities.

An efficient STO actively seeks proof that its books and records are accurate, by comparing each component of its securities positions and cash balances with the outside world on a daily basis, as well as ensuring that its books and records reconcile internally.

An STO's complete picture of an individual security can be summarised by comparing its:

- trading position (also known as the ‘ownership’ position) with

- the sum of the open trades and the settled position (collectively ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.