Chapter 6

Lines of Defences for Sharī`ah Non-Compliance Risk Management

6.0. INTRODUCTION

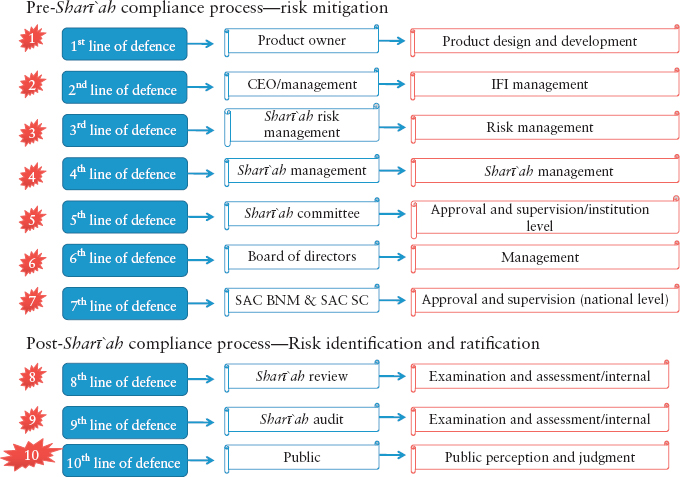

To prevent a Sharī`ah non-compliance risk event, there are some measurements and processes that have been carefully implemented in the IFI as part of risk management for non-Sharī`ah compliance risk.

These represent the lines of defence that are shown in Figure 6.1.

FIGURE 6.1 The Lines of Defence in Islamic Financial Institutions

6.1. THE FIRST LINE OF DEFENCE: PRODUCT OWNER

The product owner represents the first line of defence in Sharī`ah non-compliance. The team that develops the product, instrument, or the facility is the first line that screens the product and ensure it compliance to the Sharī`ah rules and principles. In structuring the product, the team in collaboration with the Sharī`ah management should employ its best effort to make sure that the product structure is designed in such a way that it complies with the Sharī`ah requirements and avoids any term or condition that may expose the product to Sharī`ah non-compliance.

6.1.1. Guidelines on Sharī`ah Compliance Product Development

Structuring the products in Islamic finance should be guided by some guidelines. The development of the products should be governed by the following parameters in order to ensure Sharī`ah compliance status:1

- Selection of niche product and niche market: The development process in product compliance ...

Get Shari'ah Non-compliance Risk Management and Legal Documentations in Islamic Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.