CHAPTER TWENTY

THE GOOD, THE BAD AND THE UGLY OF FINANCING

Making sure you have enough money in the bank is Step 1 in financing your business. Step 2 is finding the money when you need it. This is one of those topics that can take up a whole book (including Venture Deals by Brad Feld and Jason Mendelson) but the high-level overview here should get you pointed in the right direction.

Let's start with the premise that there are three forms of financing for your business: equity, debt, and bootstrapping. The difference is that selling equity is trading cash for ownership in your company; taking on debt means you need to pay the cash back; and bootstrapping means neither—but it might be impossible for you, depending on the business you're building. One of the most important principles to remember here is that debt is always senior to equity (meaning it always gets paid out first).

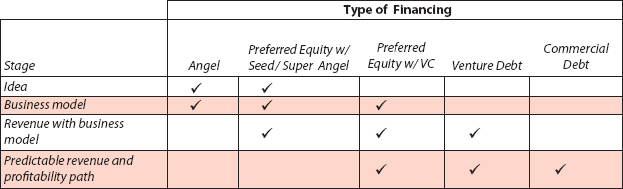

What kind of financing should you be looking for at the current stage of your startup? Review this matrix from Return Path Cofounder and CFO Jack Sinclair to find out (Figure 20.1).

FIGURE 20.1 What kind of financing should you be looking for at the current stage of your startup?

EQUITY INVESTORS

When CEOs think of equity investors, the first words that usually come to mind are venture capitalists (VCs). VCs aren't the only investors in the startup world. Inexperienced CEOs often learn this lesson too late, ...

Get Startup CEO: A Field Guide to Scaling Up Your Business, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.