CHAPTER 1

Cash-Flow Structures

If I listened to my customers, I would have invented a very fast horse.

—Henry Ford

1.1 GETTING STARTED

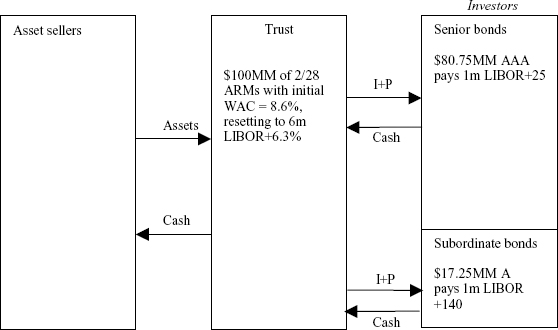

A simplified “cash” structure, also known as a “true sale” structure, is illustrated in Figure 1.1. A seller sells assets into a trust from which bonds are issued to investors. The adjective “cash” is used to denote that real assets are purchased with cash collected from issued bonds. This is opposed to a synthetic structure where credit default swaps (CDSs) are entered into (discussed later in this chapter). The adjective “true sale” refers to the transfer of the assets into a trust or special-purpose vehicle (SPV) from the sellers. The transfer is a legal sale, isolating the assets from the seller.

FIGURE 1.1 Simplified Cash Securitization Structure (Not Drawn to Scale)

The assets reside in the trust and generate interest and principal (I + P) cash flows. These collateral cash flows are routed to the various bonds that were issued as liabilities. The rationale behind this generic structure is to transform a group of assets with certain average credit risk into a set of bonds of distinct credit risks. These risks may be formalized by virtue of having a rating agency assign ratings (e.g., senior bonds are rated AAA).1 The bonds are partitioned in an attempt to meet investor demand for different risks. The structure satisfies various counterparties ...