CHAPTER 14

Commercial Mortgage-Backed Securities

Brian P. Lancaster

Senior Analyst

Wachovia Capital Markets, LLC

Anthony G. Butler, CFA

Senior CMBS Analyst

Wachovia Capital Markets, LLC

Greg Laughton

Analyst

Wachovia Capital Markets, LLC

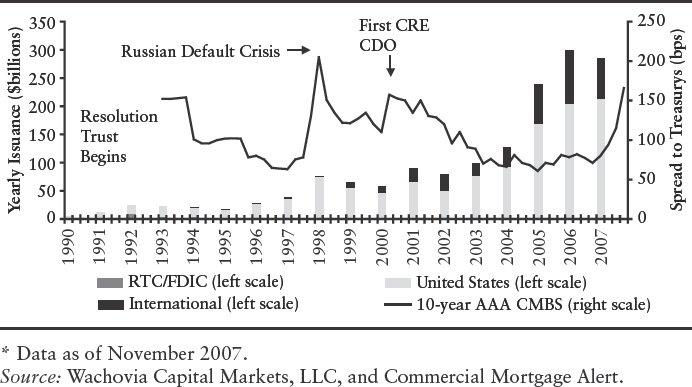

Commercial mortgage-backed securities (CMBS) came into existence in the late 1980s through private-placement transactions, but it was the Resolution Trust Corp. (RTC) in 1991–1992 that provided the initial jumpstart to the CMBS market as we now know it. CMBS are structured and rated bonds backed by commercial real estate mortgage loans. The RTC helped to create the first basic bond structures1 backed by commercial real estate that were widely accepted by investors and traded in the capital markets. Since then, the CMBS market, driven by increasingly efficient bond structures from the borrower and investor perspectives, has experienced tremendous growth in absolute terms as shown in Exhibit 14.1 and had been increasingly taking market share from more traditional on-balance-sheet lenders, such as insurance companies and government-sponsored enterprises that lend in the multifamily space.

EXHIBIT 14.1 History of the CMBS Market

After a slow but steady start, CMBS had a significant year in 1998. Experiencing average annual issuance growth of 37% up until 1998, CMBS issuance ballooned to about $80 billion. However, beginning in about August 1998, the ...

Get Structured Products and Related Credit Derivatives: A Comprehensive Guide for Investors now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.