CHAPTER 18

Government National Mortgage Association Multifamily Deals

Brian P. Lancaster

Senior CMBS Analyst

Wachovia Capital Markets, LLC

Anthony G. Butler, CFA

Senior CMBS Analyst

Wachovia Capital Markets, LLC

Landon C. Frerich

CMBS Analyst

Wachovia Capital Markets, LLC

Stephen P. Mayeux

CMBS Analyst

Wachovia Capital Markets, LLC

This chapter is designed to educate the newcomer about the Government National Mortgage Association (GNMA) multifamily securities market and provide the seasoned investor with an updated view of the sector's credit performance and prepayment speeds. GNMA multifamily securities are backed by U.S. guaranteed pools of multifamily loans.

THE PATH TO A GNMA MULTIFAMILY DEAL

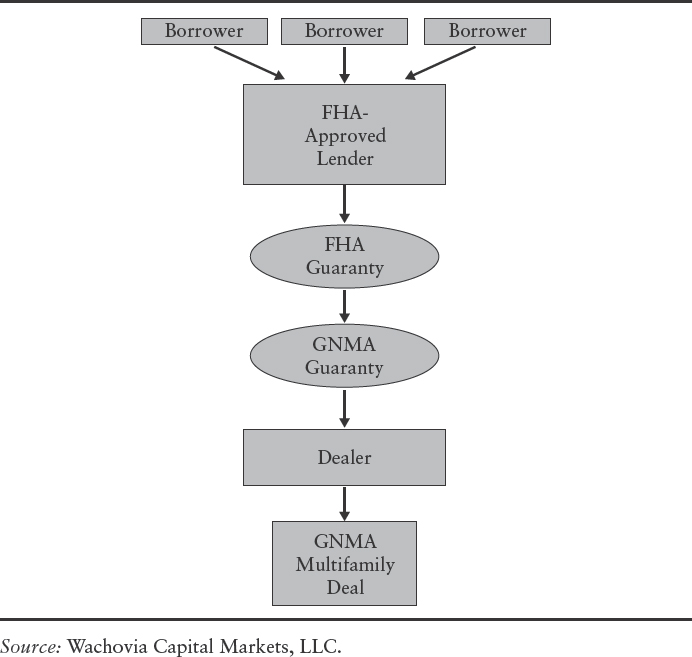

The creation of a GNMA multifamily project loan pool/deal involves essentially three steps: (1) obtaining the Federal Housing Administration guaranty; and (2) obtaining the GNMA guaranty; and (3) GNMA deal creation. (See Exhibit 18.1.)

EXHIBIT 18.1 The Path to a GNMA Multifamily Deal

Step 1: Federal Housing Administration (FHA) Guaranty

The first step for any GNMA multifamily deal begins with the Federal Housing Administration (FHA).1 The FHA provides mortgage insurance for multifamily and single-family loans originated by FHA-approved lenders.2 FHA-approved lenders can be, but are not limited to, commercial banks, insurance companies, mortgage banks, savings and loan institutions, pension ...

Get Structured Products and Related Credit Derivatives: A Comprehensive Guide for Investors now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.