CHAPTER 8Inflation Protection

Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.

—Ronald Reagan

In 1978, when then–presidential candidate Ronald Reagan likened inflation to a mugger, it struck a nerve. Inflation was running at a 9 percent annual clip, on its way to nearly 15 percent two years later. Inflation was a harsh reality.

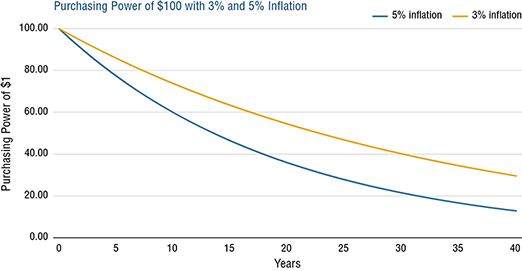

In 2016 as I write this book, inflation is tame, and the voices of monetary hawks have been drowned out. The modernization of banking over time now means there is a much lower likelihood that we could ever experience high single- or double-digit inflation as in the 1970s. Instead, the “mugger” is more likely to be a “stealthy pickpocket” that can significantly erode an individual’s purchasing power over time. But for retirees, who often depend on income that does not adjust with inflation, even relatively tame inflation—the stealthy pickpocket, not the armed robber—can be devastating. Consider: After 20 years of 3 percent annual inflation, $50,000 in retirement income would buy only about $27,000 worth of goods and services; with 5 percent inflation, the value shrivels to only about $18,000 (Figure 8.1 shows the impact of inflation on your purchasing power over time).

FIGURE 8.1 Inflation Can Cripple Purchasing Power in Retirement

Source: PIMCO.

Thus when it comes to investing for retirement, consultants ...

Get Successful Defined Contribution Investment Design now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.