CHAPTER 3

IS A PENSION ANNUITY WORTH IT?

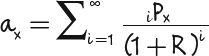

EQUATION #3: EDMOND HALLEY (1656–1742)

Toward the end of the 17th century, politicians and bureaucrats in London, England, were facing a problem not unlike that faced by many aging cities in the early 21st century. For years, they had made promises to pay lifetime pensions to the city's residents, but hadn't bothered to properly estimate what those liabilities were worth or how much they should set aside to pay pensions. Using today's modern financial terminology, they had large unfunded off-balance sheet liabilities, which they were fairly ignorant about. In the same vein, insurance companies were selling individual annuities to people of all ages but were charging them a flat, fixed price regardless of how old or how young they were.

In fact, various kings and queens were in the habit of borrowing money from their loyal subjects, with a promise to pay them back a lifetime pension, but had similarly never bothered to set aside or compute reserves to make those payments. According to some historians, the French treasury issued life annuities (rentes viagères) instead of regular bonds at extremely generous yields that were the same for young and old alike. It is said that this led to the treasury's ultimate bankruptcy prior to the French Revolution.

Anyway, the challenge of properly pricing and valuing a life annuity took on greater visibility ...

Get The 7 Most Important Equations for Your Retirement: The Fascinating People and Ideas Behind Planning Your Retirement Income now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.