CHAPTER 7 How Institutional Investors Evaluate Fund Managers

“Under the spreading chestnut tree I sold you and you sold me”

—George Orwell, 1984

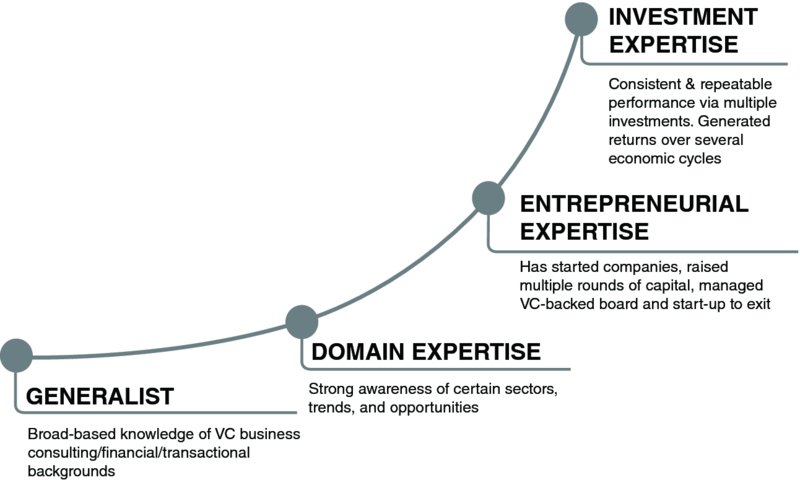

From any institutional investor's or limited partner's (LP's) perspective, a venture capital partnership is like being locked in a 10-year blind pool—a long relationship in which the investors have very little control, limited ability to exit the relationship, and no clarity of outcomes. Thus, investors seek proven fund managers. Figure 7.1 depicts the stacking order of professionals.

FIGURE 7.1 GP expertise: Show me the money!

A proven fund manager is one who has generated consistent returns across multiple economic cycles. Few practitioners have demonstrated the ability to source opportunities, invest capital over multiple rounds, add tangible value as a board member, and generate exits. Such a proven manager is a much sought after star in the venture capital business. Proven managers do not have to amplify or sell their background, expertise, or scientific domain knowledge. LPs don't really care how they got there as long as they rack up the returns. Rookies eager to enter the business have to establish their credentials.

If a newcomer has entrepreneurial experience—started a company, raised multiple venture rounds, and led the company to an exit—the fund-raising path becomes a bit easier. A demonstrated nose for choosing good ...

Get The Business of Venture Capital: Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.