CHAPTER 12 The Fund-Raising Process

“Nothing in the world is worth having or worth doing unless it means effort, pain, difficulty. . . . I have never in my life envied a human being who led an easy life. I have envied a great many people who led difficult lives and led them well.”

—Theodore Roosevelt

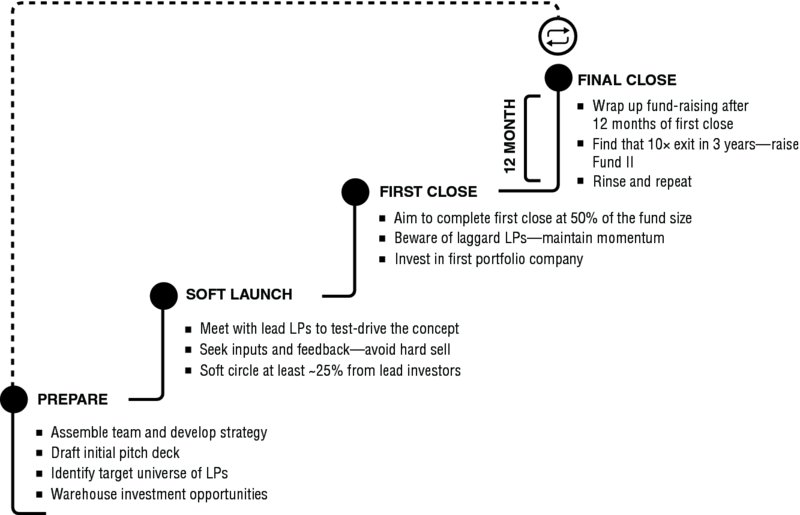

Having reviewed the universe of investors, their investment criteria, terms, and fund structure, we look at getting to the finish line—getting the fund to a close—the process of admitting investors into the fund. Most funds have a two-step closing process: a first close followed by the final close, unless of course you are Andreessen Horowitz, Foundry Group, or Greylock and can raise the capital in a matter of few weeks.1 After the fund has closed, the exhilarating or exhausting process of raising capital comes to an end.

The process of closing, or the first close, as depicted in Figure 12.1, can occur typically at about 40 to 70 percent of the size of the fund. For example, a $20 million fund can conduct its first close at $10 million or higher. The final close occurs ideally within 12 months of the first close. Conducting the first close allows a general partnership to start making investments and collecting fees.

FIGURE 12.1 Steps to fund closing.

When sufficient financial commitments have been gathered, the attorney sets a closing date. Prior to closing, the following ...

Get The Business of Venture Capital: Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.