CHAPTER 25 Acquisitions: The Primary Path to an Exit

“Fighting and scars are part of a trader’s overhead. But fighting is only useful when there’s money at the end, and if I can get it without, so much the sweeter.”

—Isaac Asimov, Foundation

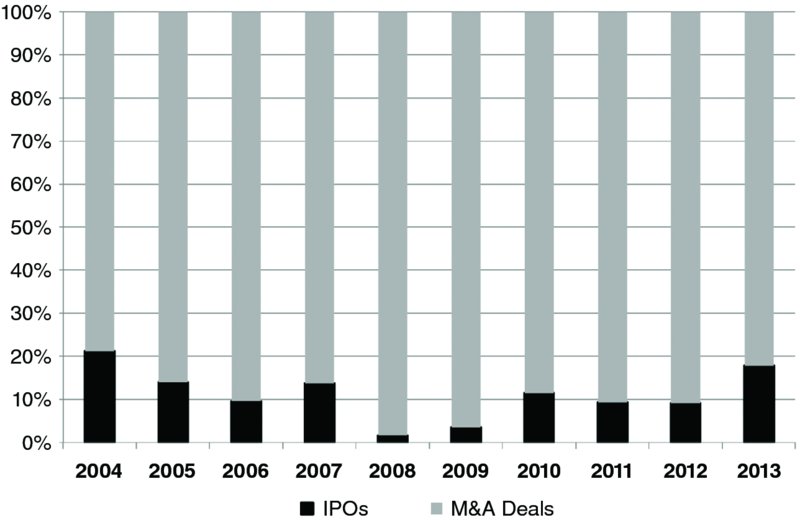

In a study of 11,500 venture capital–backed companies that raised capital between 1995 and 2008, 65.21 percent exited through either an initial public offering (IPO) or mergers and acquisitions (M & A). Within this universe, the vast majority of the exits were acquisitions, and only 9.61 percent of them achieved exit via a public offering.1

As seen in Figure 25.1, acquisitions are significantly larger as compared to public offerings.

FIGURE 25.1 Liquidity events of VC-backed companies.

Source: NVCA

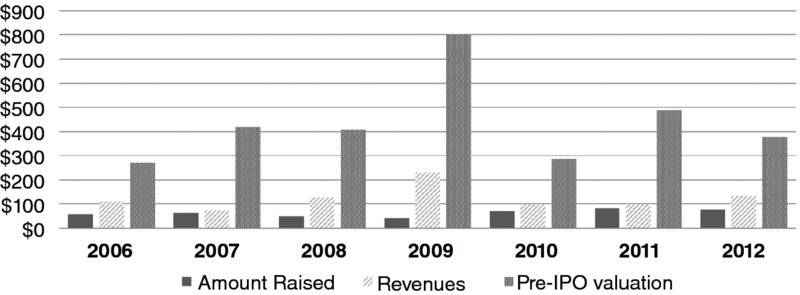

Acquisitions are the preferred path for most venture-backed companies due to speed and efficiency, as well as minimal regulatory challenges. Acquisitions offer larger companies much needed growth and expansion opportunities. Figure 25.2 shows median sales at IPO for VC-backed companies.

FIGURE 25.2 Median Sales at IPO

Source: Preqin

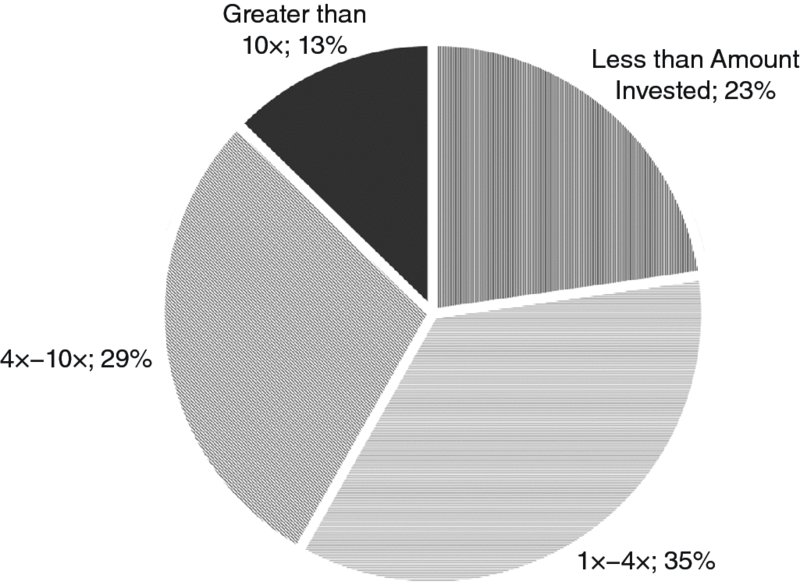

As seen in Figure 25.3, only about 10 percent of all acquisitions offer more than 10X returns.

Get The Business of Venture Capital: Insights from Leading Practitioners on the Art of Raising a Fund, Deal Structuring, Value Creation, and Exit Strategies, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.