CHAPTER 2 The Death of Capital

Capital is a powerful and complex phenomenon that many thinkers have struggled to define over the centuries. The statement that capital died in 2008 is intended to mean that after years of being misunderstood, abused, and wasted, capital stopped flowing around the world and became totally frozen in place. The manifestation of its death was the abrupt slowdown in economic activity that occurred in September 2008, around the time the U.S. investment banking firm Lehman Brothers declared bankruptcy and the U.S. government was forced to prop up AIG with $85 billion of loans (which ultimately rose to $170 billion in assistance).

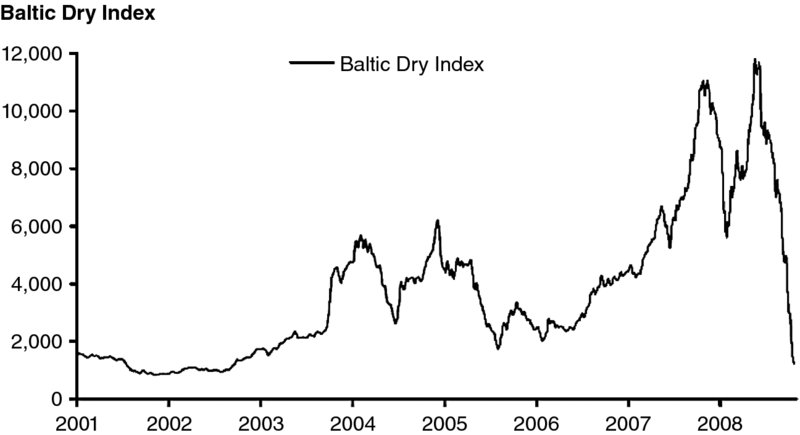

One of the most graphic illustrations of the cessation of economic activity that occurred in late 2008 is what happened to the Baltic Dry Index, a daily measure of global shipping activity.1

Figure 2.1 shows this index falling off a cliff in September 2008, signaling the sudden collapse of global economic activity as capital flows came to a standstill. This index was considered to be a leading indicator of global economic activity at the time and measured the price of moving the world’s raw materials around the globe. By the end of 2008, nothing was moving around the globe. Capital had indeed died.

Figure 2.1 Capital RIP September 2008

SOURCE: Bloomberg.

One of the key characteristics of capital is that it is a process ...

Get The Committee to Destroy the World now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.